I. MAIN HUMAN RIGHTS

Britain has a long history of respecting an individual’s rights and ensuring essential freedoms. These rights have their roots in Magna Carta, the Habeas Corpus Act and the Bill of Rights of 1689, and they have developed over a period of time. British diplomats and lawyers had an important role in drafting the European Convention on Human Rights and Fundamental Freedoms. The UK was one of the first countries to sign the Convention in 1950.

Some of the principles included in the European Convention on Human Rights are: right to life, prohibition of torture, prohibition of slavery and forced labour, right to liberty and security, right to a fair trial, freedom of thought, conscience and religion, freedom of expression (speech).

The Human Rights Act 1998 incorporated the European Convention on Human Rights into UK law. The government, public bodies and the courts must follow the principles of the Convention.

II. EQUAL OPPORTUNITIES

UK laws ensure that people are not treated unfairly in any area of life or work because of their age, disability, sex, pregnancy and maternity, race, religion or belief, sexuality or marital status.

If you face problems with discrimination, you can get more information from the Citizens Advice Bureau or from one of the following organisations:

England and Wales: Equality and Human Rights Commission (www.equalityhumanrights.com)

Scotland: Equality and Human Rights Commission in Scotland (www.equalityhumanrights.com/scotland/the-commission-inscotland) and Scottish Human Rights Commission (www.scottishhumanrights.com)

Northern Ireland: Equality Commission for Northern Ireland (www.equalityni.org)

Northern Ireland Human Rights Commission (www.nihrc.org).

III. DOMESTIC VIOLENCE

In the UK, brutality and violence in the home is a serious crime. Anyone who is violent towards their partner – whether they are a man or woman, married or living together – can be prosecuted. Any man who forces a woman to have sex, including a woman’s husband, can be charged with rape.

It is important for anyone facing domestic violence to get help as soon as possible. A solicitor or the Citizens Advice Bureau can explain the available options. In some areas there are safe places to go and stay in, called refuges or shelters. There are emergency telephone numbers in the helpline section at the front of Yellow Pages, including, for women, the number of the nearest women’s centre. You can also phone the 24-hour National Domestic Violence Freephone Helpline on 0808 2000 247 at any time, or the police can help you find a safe place to stay.

IV. FEMALE GENITAL MUTILATION

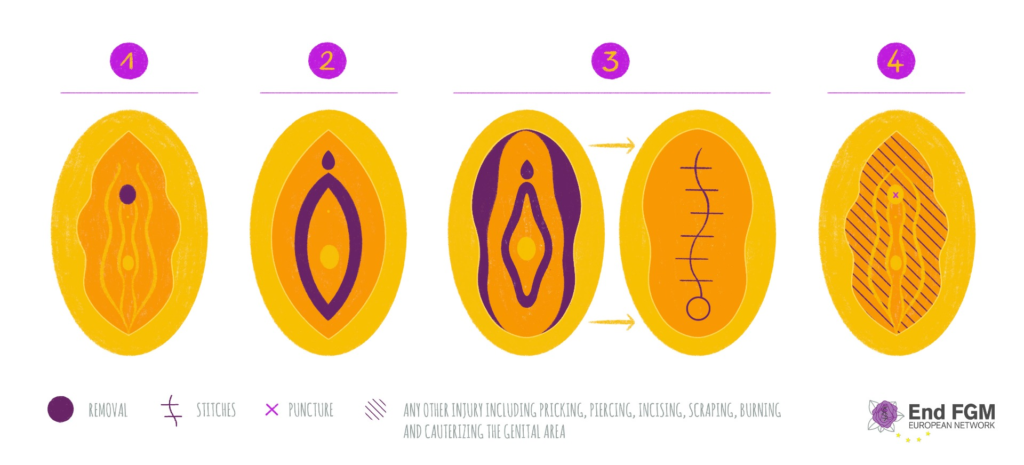

Female genital mutilation (FGM), also known as cutting or female circumcision, is illegal in the UK. Practising FGM or taking a girl or woman abroad for FGM is a criminal offence.

V. FORCED MARRIAGE

A marriage should be entered into with the full and free consent of both people involved. Arranged marriages, where both parties agree to the marriage, are acceptable in the UK.

Forced marriage is where one or both parties do not or cannot give their consent to enter into the partnership. Forcing another person to marry is a criminal offence.

Forced Marriage Protection Orders were introduced in 2008 for England, Wales and Northern Ireland under the Forced Marriage (Civil Protection) Act 2007. Court orders can be obtained to protect a person from being forced into a marriage, or to protect a person in a forced marriage. Similar Protection Orders were introduced in Scotland in November 2011.

A potential victim, or someone acting for them, can apply for an order. Anyone found to have breached an order can be jailed for up to two years for contempt of court.

VI. TAXATION

Income tax – People in the UK have to pay tax on their income, which includes: wages from paid employment, profits from self-employment, taxable benefits, pensions, income from property, savings and dividends.

Money raised from income tax pays for government services such as roads, education, police and the armed forces.

For most people, the right amount of income tax is automatically taken from their income from employment by their employer and paid directly to HM Revenue & Customs (HMRC), the government department that collects taxes. This system is called ‘Pay As You Earn’ (PAYE). If you are self-employed, you need to pay your own tax through a system called ‘self-assessment’, which includes completing a tax return. Other people may also need to complete a tax return. If HMRC sends you a tax return, it is important to complete and return the form as soon as you have all the necessary information.

You can find out more about income tax at www.hmrc.gov.uk/incometax. You can get help and advice about taxes and completing tax forms from the HMRC self-assessment helpline, on 0845 300 0627, and the HMRC website at www.hmrc.gov.uk.

VII. NATIONAL INSURANCE

Almost everybody in the UK who is in paid work, including self-employed people, must pay National Insurance Contributions. The money raised from National Insurance Contributions is used to pay for state benefits and services such as the state retirement pension and the National Health Service (NHS).

Employees have their National Insurance Contributions deducted from their pay by their employer. People who are self-employed need to pay National Insurance Contributions themselves. Anyone who does not pay enough National Insurance Contributions will not be able to receive certain contributory benefits such as Jobseeker’s Allowance or a full state retirement pension. Some workers, such as part-time workers, may not qualify for statutory payments such as maternity pay if they do not earn enough.

Further guidance about National Insurance Contributions is available on HMRC’s website at www.hmrc.gov.uk/ni.

Getting a National Insurance number

A National Insurance number is a unique personal account number. It makes sure that the National Insurance Contributions and tax you pay are properly recorded against your name. All young people in the UK are sent a National Insurance number just before their 16th birthday.

A non-UK national living in the UK and looking for work, starting work or setting up as self-employed will need a National Insurance number. However, you can start work without one. If you have permission to work in the UK, you will need to telephone the Department for Work and Pensions (DWP) to arrange to get a National Insurance number. You may be required to attend an interview. The DWP will advise you of the appropriate application process and tell you which documents you will need to bring to an interview if one is necessary. You will usually need documents that prove your identity and that you have permission to work in the UK. A National Insurance number does not on its own prove to an employer that you have the right to work in the UK.

You can find out more information about how to apply for a National Insurance number at www.gov.uk.

VIII. DRIVING

In the UK, you must be at least 17 years old to drive a car or motor cycle and you must have a driving licence to drive on public roads. To get a UK driving licence you must pass a driving test, which tests both your knowledge and your practical skills. You need to be at least 16 years old to ride a moped, and there are other age requirements and special tests for driving large vehicles.

Drivers can use their driving licence until they are 70 years old. After that, the licence is valid for three years at a time.

In Northern Ireland, a newly qualified driver must display an ‘R’ place (for restricted driver) for one year after passing the test.

If your driving licence is from a country in the European Union (EU), Iceland, Liechtenstein or Norway, you can drive in the UK for as long as your licence is valid. If you have a licence from any other country, you may use it in the UK for up to 12 months. To continue driving after that, you must get a UK full driving licence.

If you are resident in the UK, your car or motor cycle must be registered at the Driver and Vehicle Licensing Agency (DVLA). You must pay an annual road tax and display the tax disc, which shows that the tax has been paid, on the windscreen. You must also have valid motor insurance. It is a serious criminal offence to drive without insurance. If your vehicle is over three years old, you must take it for a Ministry of Transport (MOT) test every year. It is an offence not to have an MOT certificate if your vehicle is more than three years old. You can find out more about vehicle tax and MOT requirements from www.gov.uk.`